Frequently Asked Questions

A credit score is a three-digit number that lenders use to assess your creditworthiness. This helps lenders evaluate you as a borrower. The FICO credit score is the most widely used. FICO scores range from 300 to 850.

The higher your credit scores, the easier it may be to get approved for new loans or lines of credit. Higher credit scores can also translate to lower interest rates, saving you money when you borrow.

The higher your credit scores, the easier it may be to get approved for new loans or lines of credit. Higher credit scores can also translate to lower interest rates, saving you money when you borrow.

A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts.

By law, positive and neutral information can be stored indefinitely, and negative information is deleted at regular intervals. The information in your report is used by credit bureaus and creditors to calculate your credit score. Every time you apply for a new loan or credit card, you authorize the company to do a credit check. This means that they review your credit report to determine your risk as a borrower.

By law, positive and neutral information can be stored indefinitely, and negative information is deleted at regular intervals. The information in your report is used by credit bureaus and creditors to calculate your credit score. Every time you apply for a new loan or credit card, you authorize the company to do a credit check. This means that they review your credit report to determine your risk as a borrower.

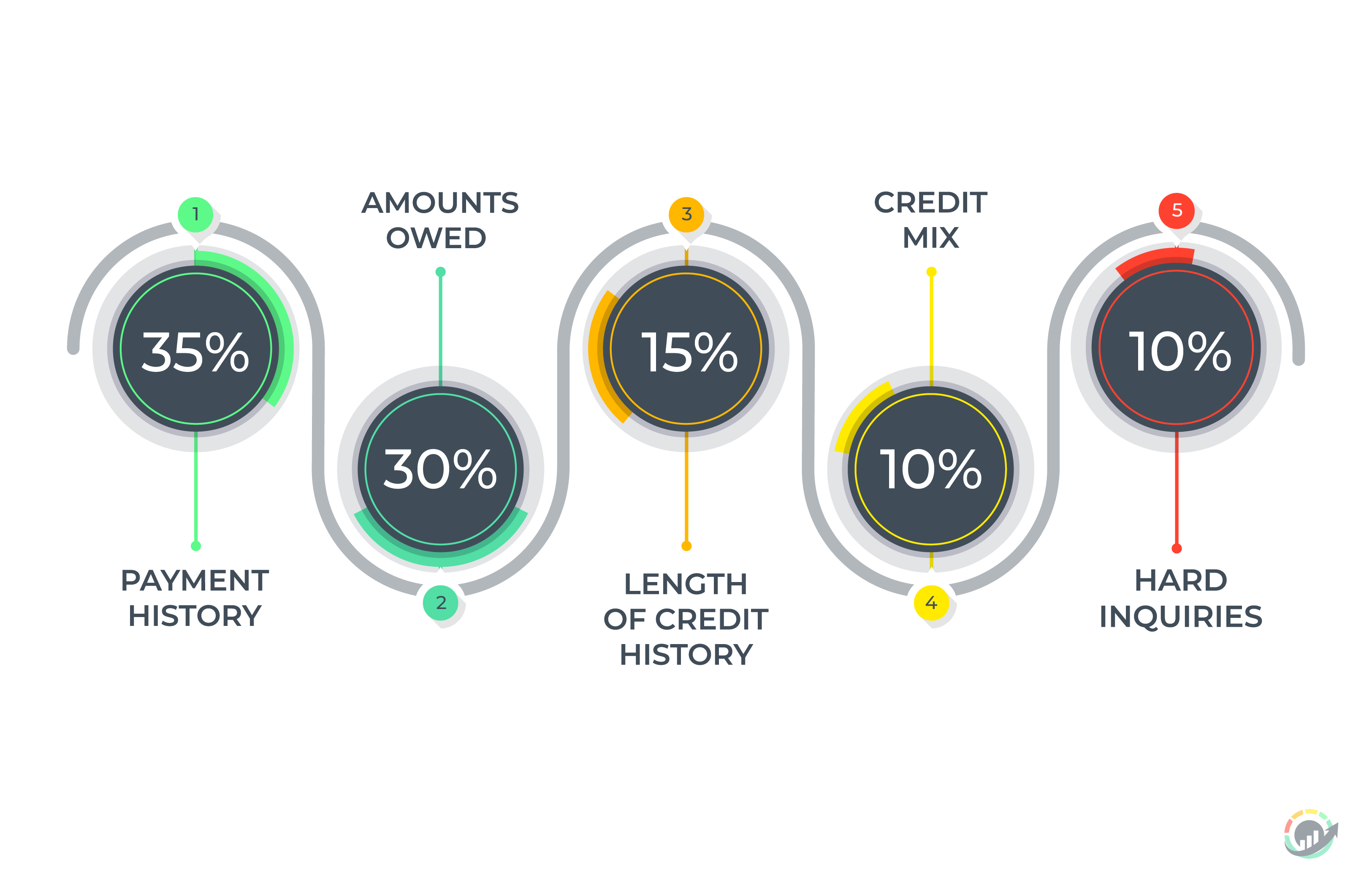

Your credit scores are determined by several factors.

Your payment history has the most impact, so make sure you pay your bills on time if you want a high score. Other factors, such as the age of your credit history and the use of your account, also cause changes in your credit score. To understand why your credit score may change, it is important to check your credit report.

Your payment history has the most impact, so make sure you pay your bills on time if you want a high score. Other factors, such as the age of your credit history and the use of your account, also cause changes in your credit score. To understand why your credit score may change, it is important to check your credit report.

Your credit score ranges from 300 to 850. The higher your credit score, the more likely you are to get a loan. The lower your score, the less chance you have. If you have a low credit score and manage to get approved for a loan, then your interest rate will be much higher than someone with a good credit score. Thus, having a high credit rating can save you thousands of dollars over the life of your mortgage, car loan, or credit card.

Credit repair is the act of restoring or correcting a poor credit score and the process of challenging errors on your credit report. Credit report errors can occur between your lenders and credit bureaus. It is a financial process of challenging these mistakes. If the information cannot be verified, it must be removed from your credit report.

No. Checking your credit score will never lower it. Only requests, known as “hard pulls,” can affect your credit score. When you apply for a new loan or credit card, then “hard pulls” appear. If you have too many new credit inquiries within six months, it may lower your credit score. All other requests are considered “soft pulls” and do not negatively affect your credit score.

Credit score recovery is not an instant process. It takes time for the credit bureaus to receive and update their files. By law, credit bureaus have 45 days to update their reports. The sooner you start the better.

Federal law says that anyone has the right to dispute errors that may appear on their credit report. This means that credit repair by itself is 100% legal, no matter where you live. You can also hire a third-party to represent you and resolve disputes on your behalf.

Free consultation

Оставьте свои контактные данные и наш менеджер свяжется с вами в ближайшее время